Geopolitical tensions and your investments

A new dimension of risk has entered the financial markets with heightened tensions in Ukraine. As you may have already seen through our weekly communications (if we manage your investments), there have been significant swings in sentiment reflected in financial markets, and the investment committee continues to monitor developments closely. It is worth reiterating though that we will maintain our long-term focus in the management of portfolios, and this means we will generally try to avoid being reactive to short-term volatility.

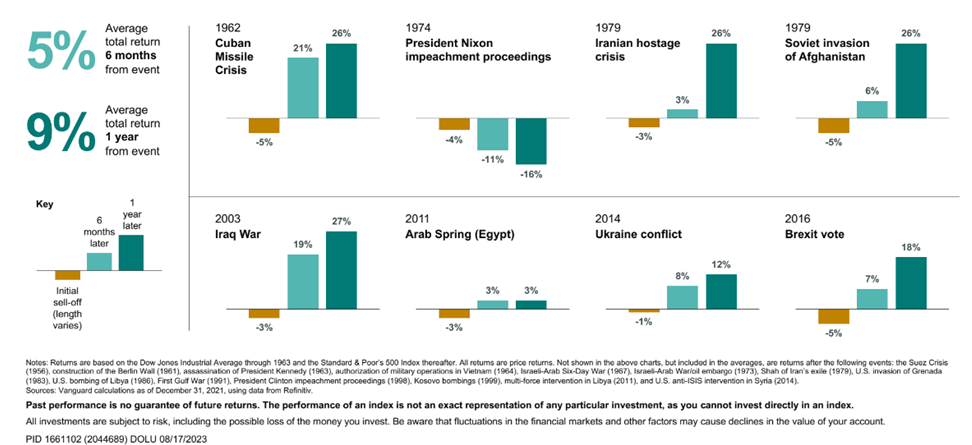

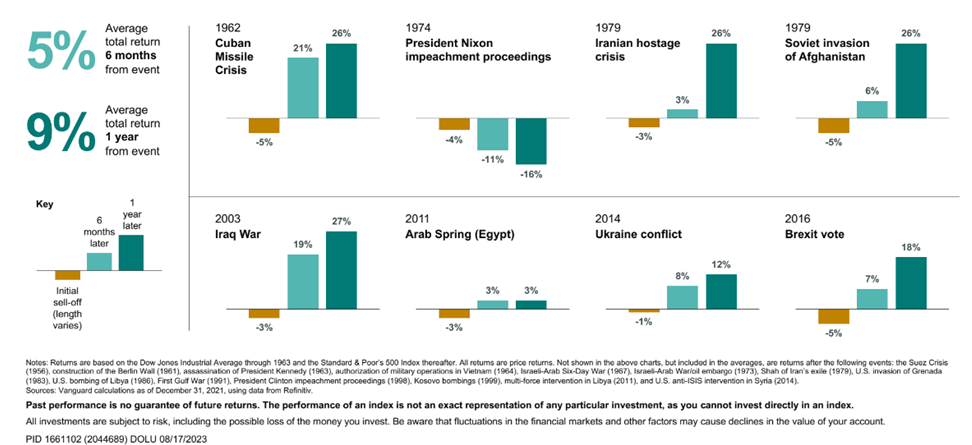

What history shows us

Why don’t we make snap decisions in environments like this? We know from historic events, that equity markets in the context of geopolitical risks are resilient and that sell-offs are typically short-lived:

Have a long term plan

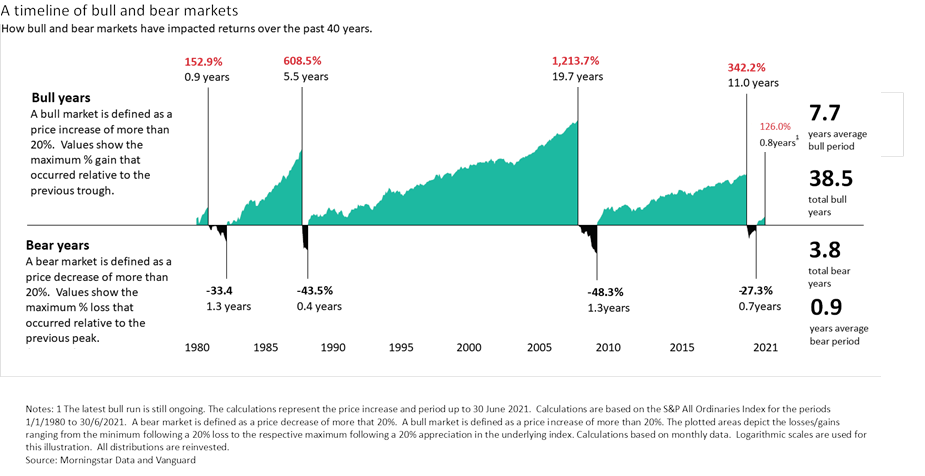

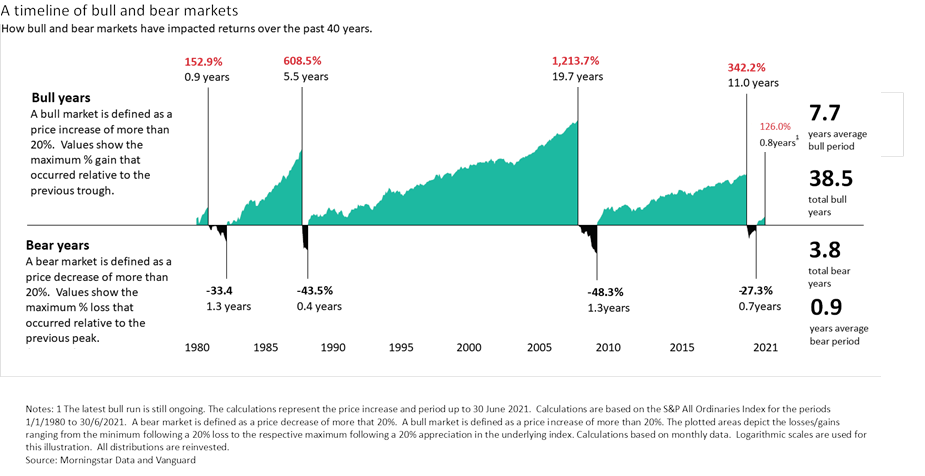

When we create your long term strategic plan (for our clients who have been through our financial planning process), we factor in downturns and bear markets. We focus on controlling the things that can be controlled to maximise your position and build strategies that can put you in the best possible position to meet your overall pre-and post-retirement goals.

Stay the Course

Now more than ever it is important to reinforce the need to lean into a few time-tested investment principles:- Make compounding work for you,

- Stay the Course, and

- Avoid trying to pick next year’s winners. Focus on ensuring investments are well diversified as this will be a critical step in navigating a more tumultuous landscape going forward.